ADVISORY VOTE “FOR” THE ELECTION OF THE NOMINEES NAMED BELOW.

Director Nominees

Terence J. Cryan

Chairman of the Board and Chairman of the Nominating and Corporate Governance Committee

Terence J. Cryan rejoined the Westwater Resources Board as its Chairman in August 2017. He previously served as a director from October 2006 to March 2016, served as Westwater’s Interim President and Chief Executive Officer from September 2012 to March 2013, and served as Chairman of the Board from June 2014 through March 2016. Mr. Cryan is also Chairman of the Board of Ocean Power Technologies, Inc. where he has served as a director since October 2012.

Mr. Cryan currently serves as a Managing Director of MACCO Restructuring Group, LLC, which provides qualified interim leadership and advice to debtors and their stakeholders across a broad spectrum of business sectors. Mr. Cryan served as President and Chief Executive Officer of Global Power Equipment Group Inc. from March 2015 until July 2017. Previously, Mr. Cryan served as Co-founder and Managing Director of Concert Energy Partners, an investment and private equity firm based in New York City from 2001 until 2015. Prior to that, Mr. Cryan was a Senior Managing Director in the Investment Banking Division at Bear Stearns. Additionally, Mr. Cryan was a Managing Director, Head of the Energy and Natural Resources Group and member of the Investment Banking Operating Committee at Paine Webber which he joined following its acquisition of Kidder, Peabody in 1994. From 2007 to 2010, Mr. Cryan also served as President and Chief Executive Officer of Medical Acoustics LLC.

Mr. Cryan served as a Director on the Board of Global Power Equipment Group Inc. from January 2008 until July 2017. Mr. Cryan was previously a Director on the Board of Superior Drilling Products, Inc. from June 2014 to December 2016. He was also previously a director of The Providence Service Corporation from May 2009 to May 2011 and Gryphon Gold Corporation from August 2009 to December 2012. Mr. Cryan has also been an adjunct professor at the Metropolitan College of New York Graduate School of Business and is a frequent speaker at finance and energy & natural resources industry gatherings. Mr. Cryan received a Master of Science degree in Economics from the London School of Economics in 1984 and a Bachelor of Arts degree in Economics from Tufts University in 1983. Mr. Cryan is a Board Leadership Fellow and member of the National Association of Corporate Directors.

Mr. Cryan’s extensive financial industry experience and educational background in economics provide him with a wealth of knowledge in dealing with financial, accounting and regulatory matters. Mr. Cryan’s prior professional experience also permits him to provide valuable advice to the Company with respect to potential capital raising and merger and acquisition transactions, and his prior Board service and service as Interim President and Chief Executive Officer of the Company provides him a deep understanding of the operations of the Company.

Christopher M. Jones

President and Chief Executive Officer

Chairman of the Health, Safety and Environment Committee

Christopher M. Jones has served as President and Chief Executive Officer and a director since April 2013 and served as the interim Chairman of the Board from March 2016 to August 2017. Mr. Jones has more than 30 years’ experience in the mining industry and was most recently President, Chief Executive Officer and a director of Wildcat Silver Corporation from August 2008 to May 2012, where he and his team effectively doubled the size of Wildcat Silver’s resources twice using proven metallurgical technologies. Prior to that, Mr. Jones was the Chief Operating Officer and the Mining General Manger at Albian Sands Energy from April 2004 to June 2008. Mr. Jones also held management positions at RAG Coal West Inc., Phelps Dodge Sierrita Corp. and Cyprus Amax Coal Company. He is a member of the American Institute of Mining, Metallurgical, and Petroleum Engineers and is a Professional Engineer registered in Utah and Alberta as well as a member of the National Association of Corporate Directors. Mr. Jones received a Bachelor of Science degree in Mining Engineering at the South Dakota School of Mines and a Master of Business Administration degree from Colorado State University.

Mr. Jones has extensive executive and leadership experience as a result of his prior employment in management roles at other companies within the mining industry, which enables him to provide valuable counsel to Westwater on issues of strategic planning and corporate governance. Mr. Jones’ extensive experience engaging First Nations peoples on Canada, leading efforts to implement The Mining Association of Canada’s Towards Sustainable Mining process, successful efforts to secure ISO 14001 certifications, and receiving national safety awards for safe mine performance will help secure success for Westwater as it develops businesses in the energy materials sector. In addition, Mr. Jones has a history of leading various mining and production operations, as well as exploration and development projects, which will be useful to Westwater in its efforts to develop its Coosa Graphite Project in Alabama.

Tracy D. Pagliara

Member of the Audit, Compensation and Nominating and Corporate Governance Committees

Tracy D. Pagliara has served as a director since July 2017. Since April 2018, Mr. Pagliara has been serving as CEO of Williams Industrial Services Group Inc. (f/k/a Global Power Equipment Group, Inc.), a publicly traded provider of construction and maintenance services to the power, energy and industrial customers (“Williams”). From July 2017 to April 2018, Mr. Pagliara served as Co-President and Co-CEO of Williams. Mr. Pagliara joined Williams in April 2010 as General Counsel, Secretary and Vice President, Business Development and served in multiple other positions of increasing responsibility, including Senior Vice President, Administration, prior to his appointment as Co-President and Co-CEO in July 2017. Prior to joining Williams in April 2010, Mr. Pagliara served as the Chief Legal Officer of Gardner Denver, Inc., a leading global manufacturer of highly engineered compressors, blowers, pumps and other fluid transfer equipment, from August 2000 through August 2008. He also had responsibility for other roles during his tenure with Gardner Denver, including Executive Vice President of Administration, Chief Compliance Officer, and Corporate Secretary. Prior to joining Gardner Denver, Mr. Pagliara held positions of increasing responsibility in the legal departments of Verizon Communications/GTE Corporation from August 1996 to August 2000 and Kellwood Company from May 1993 to August 1996, ultimately serving in the role of Assistant General Counsel for each company. Mr. Pagliara has a B.S. in Accounting and a J.D. from the University of Illinois. He is a member of the Missouri and Illinois State Bars and a Certified Public Accountant.

Mr. Pagliara brings to the Board extensive experience advising public companies and companies in the energy industry, in addition to companies with similar capital needs to Westwater. Mr. Pagliara’s background in accounting will also permit him to contribute substantially as a member of the Audit Committee.

Karli S. Anderson

Chair of the Compensation Committee and Member of the Audit and the Health, Safety and Environment Committees

Karli S. Anderson is Vice President, Investor Relations at Summit Minerals, Inc., a leading vertically-integrated materials company with operations throughout North America. She previously served as Vice President, Investor Relations for Royal Gold, Inc., a precious metals stream and royalty company engaged in the acquisition and management of precious metal streams, royalties, and similar production-based interests with over 190 properties on six continents. Previously, from 2010 to 2013, Ms. Anderson was a Senior Director of Investor Relations for Newmont Mining Corporation, one of the world’s largest gold producers. Ms. Anderson’s 20 years of capital markets experience includes shareholder engagement related to environmental, social and governance (ESG) factors with both equity and fixed income investors as well as proxy advisory firms. From 2012 to 2018, Ms. Anderson served as Chairman of the Board of the Denver Gold Group, an organization representing seven-eighths of the world’s publicly traded gold and silver companies. Ms. Anderson holds a Bachelor’s Degree in telecommunications from Ohio University, a Masters of Business Administration (finance) from the Wharton School at the University of Pennsylvania and is in the process of completing her Master’s Degree in Professional Accounting from Colorado State University. Ms. Anderson is a Governance Fellow and member of the National Association of Corporate Directors.

Ms. Anderson’s insights and guidance, her wealth of experience in the mining industry, as well as her advocacy towards greater corporate governance within the investment community, will continue to be critical assets to Westwater.

Deborah A. Peacock

Chair of the Audit Committee, Member of the Compensation Committee

Ms. Peacock is an attorney licensed to practice law in New Mexico, Colorado and New York, and she is a Registered Patent Attorney. Ms. Peacock is also a Registered Professional Engineer in Colorado and New Mexico. Ms. Peacock is the President, CEO, Managing Director and owner of Peacock Law P.C. located in Albuquerque, New Mexico, which she founded in April 1995. In 2014, Ms. Peacock co-founded the Greater New Mexico Chapter of Women Corporate Directors and currently serves on its Board.

Since 2011, Ms. Peacock has served on the Board of Regents of New Mexico Institute of Mining & Technology and currently serves as the Chair. Ms. Peacock has served on the New Mexico Mining Safety Board since 2015. Since 2017, Ms. Peacock has served on the Board of Directors of THEMAC Resources Group, Ltd. (and Chairs its Corporate Governance Committee and is a member of its Audit Committee) as well as its wholly-owned subsidiary New Mexico Copper Corp. Since 2017, Ms. Peacock has served on the Board of Directors of New Mexico Gas Company, and since 2018 she has served on the Board of Directors of Emera Technologies, LLC – both wholly-owned subsidiaries of Emera, Inc. Ms. Peacock has served on the Board of New Mexico Angels since 2005. In addition to her current Board service, Ms. Peacock previously served on the Board of The Georgia O’Keeffe Museum located in Santa Fe, New Mexico and both its Audit and Executive Committees, and as Chair of its Audit Committee. She previously served on the New Mexico Environmental Improvement Board and as Chair for four years.

Ms. Peacock obtained her Bachelors of Science degree (B.S.) in Metallurgical Engineering from the Colorado School of Mines, and her Law Degree (J.D.) from Harvard Law School. She is also a Governance Fellow with the National Association of Corporate Directors. Ms. Peacock brings to the Board extensive experience in or with corporate governance, financial oversight, a wide variety of business and corporate legal matters including intellectual property and mergers & acquisitions, and has knowledge of mining and metallurgy industries, environmental regulations, permitting, and community involvement and engagement.

CORPORATE GOVERNANCE

Board of Directors

The Company’s business and affairs are overseen by the Board pursuant to the Delaware General Corporation Law and the Company’s Amended and Restated Bylaws, as amended (the “Bylaws”). Members of the Board are kept informed of the Company’s business through discussions with the Chairman and key members of management, by reviewing materials provided to them and by participating in Board and Committee meetings. All members of the Board are elected annually by the stockholders.

Regular attendance at Board meetings and the Annual Meeting is expected of each director. Our Board held 15 meetings during 2020. No director attended fewer than 75% of the total number of Board and applicable Committee meetings (held during the period that such director served) in 2020. The independent directors met in executive session at several of the Board meetings held in 2020. All of the directors at the time attended the 2020 Annual Meeting of Stockholders.

Board Leadership Structure

The Company’s governing documents allow the roles of Chairman and Chief Executive Officer to be filled by the same or different individuals. This approach allows the Board flexibility to determine whether the two roles should be separate or combined based upon the Company’s needs and the Board’s assessment of the Company’s leadership from time to time. Currently, Mr. Cryan serves as Chairman and Mr. Jones serves as Chief Executive Officer.

Determination of 2021 Director Nominees

Each of the director nominees at the 2021 Annual Meeting are existing directors of the Company and stood for election and were elected at the Company’s 2020 Annual Meeting of Directors. Criteria for financial experience, diversity, and public company experience at a senior level were used as part of the selection process. Marvin K. Kaiser served on the Westwater Board of its Directors from 2007 until the 2020 Annual Meeting.

Director Independence

The Board annually reviews all relationships that directors have with the Company to affirmatively determine whether the directors are “independent” under Nasdaq listing standards. The Board has determined that each of Ms. Anderson and Peacock and Messrs. Cryan and Pagliara are “independent” and as a result, each existing member of the Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee is “independent.” In arriving at the foregoing independence determination, the Board considered transactions and relationships between each director or any member of her or his immediate family and the Company, its subsidiaries or its affiliates. The Board has determined that the directors designated as “independent” have no relationship with the Company that would interfere with the exercise of their independent judgment in carrying out the responsibilities of a director.

Communications with the Board

Interested parties, including the Company’s stockholders, desiring to communicate with the Board members, including its non-management directors as a group, may do so by mailing a request to the Secretary of Westwater Resources, Inc. at 6950 S. Potomac Street, Suite 300, Centennial, Colorado 80112. Pursuant to the instruction of the Company’s non-management directors, the Secretary will review inquiries and if they are relevant to, and consistent with our operations, policies and procedures, they will be forwarded to the director or directors to whom they are addressed. Inquiries not forwarded will be retained by the Company and will be made available to any director upon request.

Committees of the Board

The Board has established four standing committees: an Audit Committee, a Compensation Committee, a Nominating and Corporate Governance Committee, and a Health, Safety and Environment Committee. The table below indicates the members of each standing Board Committee as of March 15, 2021.

| | | | | | | | | |

| | | | | | | Nominating and

| | Health, Safety and

|

| | | | | | | Corporate

| | Environment

|

Board Member

| | Audit

| | | Compensation

| | Governance

| | |

Terence J. Cryan*

| | | | | | | Ch.

| | |

Christopher M. Jones

| | | | | | | | | Ch.

|

Tracy D. Pagliara*

| | x

| | | x

| | x

| | |

Karli S. Anderson*

| | x

| | | Ch.

| | | | x

|

Deborah A. Peacock*

| | Ch.

| | | x

| | | | |

_____________________

* independent director

Each of the Company’s Audit Committee, Compensation Committee, and Nominating and Corporate Governance Committee operates under a charter, adopted by the Board, which is available on the Company’s website at www.westwaterresources.net under “Corporate Governance,” or in print, without charge, to any stockholder who sends a request to the office of the Secretary of Westwater Resources, Inc. at 6950 S. Potomac Street, Suite 300, Centennial, Colorado 80112. The functions performed by each of the standing Committees are briefly described below.

The Audit Committee

We have a separately-designated Audit Committee composed solely of independent directors. The Audit Committee held four meetings in 2020.

The Audit Committee’s primary responsibilities are to:

·assist the Board in discharging its responsibilities with respect to the accounting policies, internal controls and financial reporting of the Company;

·monitor compliance with applicable laws and regulations, standards and ethical business conduct, and the systems of internal controls;

·assist the Board in its oversight of the qualifications, independence and performance of the registered public accounting firm engaged to be the independent auditor of the Company; and

·prepare the Audit Committee report required to be included in the Company’s proxy statements.

The Board has determined that Ms. Peacock, the chair of the Audit Committee, and Mr. Pagliara, a member of the Audit Committee, each satisfies the criteria adopted by the SEC to serve as an “audit committee financial expert.” In addition, the Board has determined that each of Ms. Peacock, Mr. Pagliara and Ms. Anderson, constituting all current members of the Audit Committee, is an independent director pursuant to the requirements under the Exchange Act and Nasdaq listing standards and is able to read and understand the Company’s financial statements.

The Compensation Committee

The Compensation Committee held four meetings in 2020. The Compensation Committee is responsible for assisting the Board in setting the compensation of the Company’s directors and executive officers and administering and implementing the Company’s incentive compensation plans and equity-based plans. The Compensation Committee’s duties and responsibilities are to:

·review and approve corporate goals and objectives relevant to the compensation of the Company’s executive officers;

·evaluate the performance of the Company’s executive officers in light of such goals and objectives; and

·determine and approve executive officer compensation based on such evaluation.

The Compensation Committee also reviews and discusses the Compensation Discussion and Analysis appearing in the Company’s proxy statements with management, and based on such review and discussions, has recommended to the Board that the Compensation Discussion and Analysis set forth herein be included in this proxy statement.

Under the Compensation Committee Charter, the Compensation Committee has the authority to retain compensation consultants. Meridian Compensation Partners was engaged in March 2018 to review our Long-Term Incentive program to ensure it was competitive as an incentive and retention program. See the discussion under the heading “Compensation Discussion and Analysis” for further information regarding the executive compensation programs. The Compensation Committee also has the authority to obtain advice and assistance from executives, internal or external legal, accounting or other advisors as it determines necessary to carry out its duties.

The Compensation Committee may delegate its authority to determine the amount and form of compensation paid to non-executive employees and consultants to officers and other appropriate supervisory personnel. It may also delegate its authority (other than its authority to determine the compensation of the Chief Executive Officer) to a subcommittee of the Compensation Committee. Finally, to the extent permitted by applicable law, the Compensation Committee may delegate to one or more officers (or other appropriate personnel) the authority to recommend stock options and other stock awards for employees who are not executive officers or members of the Board.

The Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee held one meeting in 2020. The Nominating and Corporate Governance Committee’s duties and responsibilities are to:

·recommend to the Board director nominees for the annual meeting of stockholders;

·identify and recommend candidates to fill vacancies occurring between annual stockholder meetings; and

·oversee all aspects of corporate governance of the Company.

The Nominating and Corporate Governance Committee of the Board identifies director candidates based on input provided by a number of sources, including members of the Nominating and Corporate Governance Committee, other directors, our stockholders, members of management and third parties. The Nominating and Corporate Governance Committee does not distinguish between nominees recommended by our stockholders and those recommended by other parties. Any stockholder recommendation must be sent to the Secretary of Westwater Resources, Inc. at 6950 S. Potomac Street, Suite 300, Centennial, Colorado 80112, and must include detailed background information regarding the suggested candidate that demonstrates how the individual meets the Board membership criteria discussed below. The Nominating and Corporate Governance Committee also has the authority to consult with or retain advisors or search firms to assist in the identification of qualified director candidates.

As part of the identification process, the Nominating and Corporate Governance Committee takes into account each candidate’s business and professional skills, experience serving in management or on the board of directors of companies similar to the Company, financial literacy, independence, personal integrity and judgment. In conducting this assessment, the Nominating and Corporate Governance Committee will, in connection with its assessment and recommendation of candidates for director, consider diversity (including, but not limited to, gender, race, ethnicity, age, experience and skills) and such other factors as it deems appropriate given the then-current and anticipated future needs of the Board and the Company, and to maintain a balance of perspectives, qualifications, qualities and skills on the Board. The Board does not have a formal diversity policy for directors. However, the Board is committed to an inclusive membership. Although the Nominating and Corporate Governance Committee may seek candidates that have different qualities and experiences at different times in order to maximize the aggregate experience, qualities and strengths of the Board members, nominees for each election or appointment of directors will be evaluated using a substantially similar process. Incumbent directors who are being considered for re-nomination are re-evaluated both on their performance as directors and their continued ability to meet the required qualifications.

The Health, Safety and Environment Committee

The Health, Safety and Environment Committee held two meetings in 2020. Its function is to provide oversight to the Company as the Company undertakes and conducts, in compliance with all regulatory, statutory and the Company’s policies, its operations in an economically and socially responsible manner, with due regard to the safety and health of its employees, the impact of its operations on the natural environment, and the social, economic, health and environmental-related impacts in the communities in which the Company operates.

Code of Ethics

The Company has adopted a Code of Ethics for Senior Financial Officers, which is applicable to the Company’s chief executive officer, chief financial officer, controller, treasurer and chief internal auditor, and a Code of Business Conduct and Ethics,

which is applicable to all of directors, officers and employees. Copies of the codes are available on the Company’s website at http://www.westwaterresources.net/corporate/corporate-governance or in print, without charge, to any stockholder who sends a request to the office of the Secretary of Westwater Resources, Inc. at 6950 S. Potomac Street, Suite 300, Centennial, Colorado 80112. In the event that the Company makes any amendment to, or grants any waiver from, a provision of the Code of Ethics for Senior Financial Officers that applies to the Company’s principal executive officer, principal financial officer, principal accounting officer, controller, or certain other senior officers and requires disclosure under applicable SEC rules, the Company intends to disclose such amendment or waiver and the reasons for the amendment or waiver on the Company’s website or, as required by Nasdaq rules, file a Current Report on Form 8 K with the SEC reporting the amendment or waiver.

The Company’s Internet website address is provided as an inactive textual reference only. The information provided on the website is not incorporated into, and does not form a part of, this proxy statement.

Related Party Transactions

The Company’s general policy with respect to related party transactions is included in its Code of Business Conduct and Ethics, the administration of which is overseen by the Audit Committee. Directors and officers are required to report any transaction that the Company would be required to disclose pursuant to Item 404(a) of Securities and Exchange Commission Regulation S-K (a “Related Party Transaction”) to the Audit Committee.

The Company collects information about potential Related Party Transactions in its annual questionnaire completed by directors and officers. Potential Related Party Transactions are subject to the review and approval of the non-interested members of the Audit Committee. In determining whether to approve any such transaction, the Audit Committee will consider such factors as it deems relevant, including, but not limited to, whether the transaction is on terms comparable to those that could be obtained in arm’s length negotiations with an unrelated third party.

The Company was not a party to any Related Party Transaction since the beginning of 2018.

Board Oversight of Risk Management

The Board has overall responsibility for risk oversight with a focus on the most significant risks facing the Company. The Board relies upon the President and Chief Executive Officer to supervise day-to-day risk management, who reports directly to the Board and certain Committees on such matters as appropriate.

The Board is also responsible for oversight of the Company’s efforts to address environmental, social and corporate governance (“ESG”) matters. The Company has a long history of environmental leadership, especially with regard to state and federal regulations as they apply to our former uranium operations. In addition, we have performed our work without serious injury for several years – emblematic of our approach to safe work practices, procedures and leadership. As part of our environmental sustainability efforts as we develop our graphite business, the Westwater team has developed, and made a provisional patent application for, a process that purifies graphite with a lighter environmental footprint than processes used by others in our business. Also, as part of our ongoing efforts to provide for diversity at the Board of Directors, we have 50/50 gender representation for independent Directors.

The Board delegates certain oversight responsibilities to its Committees. For example, while the primary responsibility for financial and other reporting, internal controls, compliance with laws and regulations and ethics rests with the management, the Audit Committee provides risk oversight with respect to the Company’s financial statements, the Company’s compliance with legal and regulatory requirements and corporate policies and controls, and the independent auditor’s selection, retention, qualifications, objectivity and independence. Additionally, the Compensation Committee provides risk oversight with respect to the Company’s compensation programs, and the Nominating and Corporate Governance Committee provides risk oversight with respect to the Company’s governance structure and processes and succession planning. The Board and each Committee consider reports and presentations from the members of management responsible for the matters considered to enable the Board and each Committee to understand and discuss risk identification and risk management.

AUDIT COMMITTEE REPORT

The Audit Committee, operating under a written charter adopted by the Board, reports to and acts on behalf of the Board by providing oversight of the Company’s independent auditors and the Company’s financial management and financial reporting procedures. Management has primary responsibility for preparing the Company’s financial statements and establishing and maintaining effective internal financial controls and for the public reporting process. Moss Adams LLP, the Company’s independent registered public accountants, is responsible for auditing those financial statements and expressing an opinion on the conformity of the Company’s audited financial statements with generally accepted accounting principles.

In this context, the Audit Committee reviewed and discussed with management and Moss Adams LLP the audited financial statements for the year ended December 31, 2020, the Moss Adams audit fees, and management’s assessment of the effectiveness of the Company’s internal control over financial reporting. The Audit Committee has discussed with Moss Adams LLP the matters that are required to be discussed by the applicable Public Company Accounting Oversight Board and SEC standards. Moss Adams LLP has provided to the Audit Committee the written disclosures and the letter required by applicable requirements of the Public Company Accounting Oversight Board regarding Moss Adams LLP’s communications with the Audit Committee concerning independence, and the Audit Committee discussed with Moss Adams LLP that firm’s independence. The Audit Committee also concluded that Moss Adams LLP’s provision of audit and non-audit services to the Company and its affiliates is compatible with Moss Adams LLP’s independence.

Based on the considerations referred to above, the Audit Committee recommended to the Board that the audited financial statements for the year ended December 31, 2020 be included in the Company’s Annual Report on Form 10-K for 2020 and selected Moss Adams LLP as the independent registered public accountants for the Company for 2021.

The Report was submitted by the following members of the Audit Committee of the Board:

Deborah A. Peacock, Chair

Tracy D. Pagliara

Karli S. Anderson

The information contained in the foregoing Audit Committee Report shall not be deemed to be “soliciting material” or “filed” with the SEC, nor shall such information be incorporated by reference into a future filing under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, except to the extent the Company specifically incorporates this Report by reference therein.

DIRECTOR COMPENSATION

Annual Compensation

In 2020, the compensation of non-employee directors consisted of an annual $50,000 cash retainer, earned at a rate of $12,500 per quarter. The compensation of the Company’s Chairman of the Board, Mr. Cryan, consisted of $27,500 per quarter. All of the Company’s directors are also reimbursed for reasonable out-of-pocket expenses related to attendance at Board and Committee meetings.

In addition, each non-employee director earned $1,250 per quarter for each committee served upon, with the Chair of each committee earning either an additional $2,500 per quarter (in the case of the Audit and Compensation Committees) or $1,250 per quarter (in the case of the Nominating and Corporate Governance and the Health, Safety and Environment Committees) for such service.

Also, each non-employee director (other than Mr. Kaiser who retired from the Board in April 2020) was provided with a stock award valued at $50,000 following the annual general meeting of stockholders held in April 2020.

The following table summarizes all compensation earned by directors, excluding Mr. Jones, whose compensation is set forth in the 2020 Summary Compensation Table, in the year ended December 31, 2020.

| | | | | | |

| | Fees Earned | | | | |

| | or | | Stock | | |

| | Paid in Cash | | Awards | | Total |

Name | | ($) | | ($) (1) | | ($) |

Terence J. Cryan | | 120,000 | | 50,000 | | 170,000 |

Tracy D. Pagliara | | 65,000 | | 50,000 | | 115,000 |

Karli S. Anderson | | 75,000 | | 50,000 | | 125,000 |

Deborah A. Peacock | | 47,115 | | 50,000 | | 97,115 |

Marvin K. Kaiser | | 24,520 | | — | | 24,520 |

_____________________

(1)Represents the grant date fair value of equity awards granted during 2019 in accordance with FASB ASC Topic 718. See Note 9—Stock Based Compensation of the Notes to Consolidated Financial Statements in Item 8 of this Annual Report on Form 10-K for a discussion of valuation assumptions for stock and option awards.

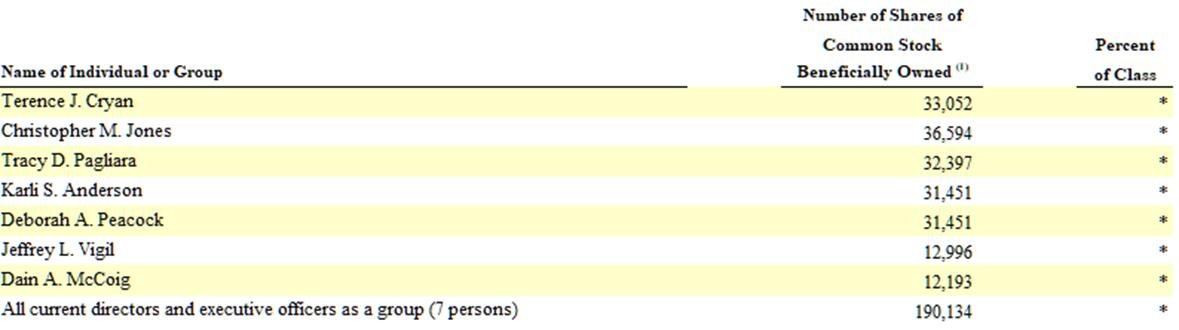

The number of RSUs and vested and unvested stock options held by each non-employee director at fiscal year-end 2020 is shown below:

| | | | | | |

| | Number of | | Number of | | Restricted |

Name | | Vested Options | | Unvested Options | | Stock Units |

Terence J. Cryan | | 946 | | 31,451 | | — |

Tracy D. Pagliara | | 946 | | 31,451 | | — |

Karli S. Anderson | | — | | 31,451 | | — |

Deborah A. Peacock | | — | | 31,451 | | — |

EXECUTIVES ANDTO APPROVE EXECUTIVE COMPENSATION

![[MISSING IMAGE: px_24proxy1pg01-bw.jpg]](https://capedge.com/proxy/PRE 14A/0001104659-24-039033/px_24proxy1pg01-bw.jpg)

![[MISSING IMAGE: px_24proxy1pg02-bw.jpg]](https://capedge.com/proxy/PRE 14A/0001104659-24-039033/px_24proxy1pg02-bw.jpg)